Upper limit

The purchasing power of Russian residents has reached a historic low, and the share of customers with free funds (funds remaining after spending on basic needs and mandatory payments) has fallen by 82%. According to Fashion Consulting Group estimates, in 2015, about 76% of buyers reduced spending on clothing, and premium brands suffered the most (30%). Some brands of the medium and medium plus segment, as a result of an increase in the exchange rate and a decrease in income, formed a segment of the so-called forced premium.

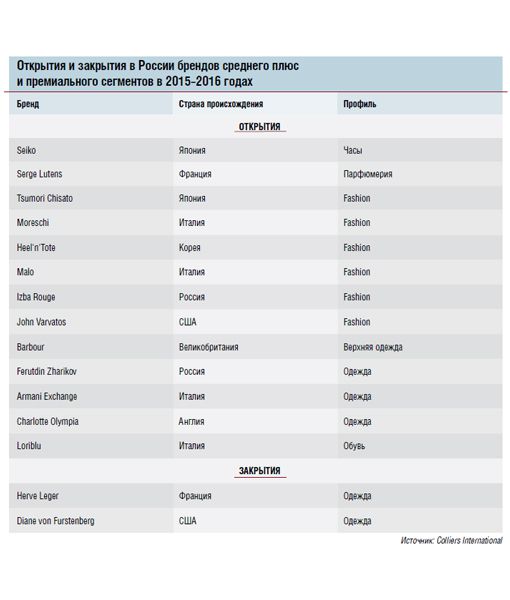

In the first half of the year, the first stores of twenty-five international brands opened in Russia. According to preliminary data from Knight Frank, compared to the same period in 2015, there were almost twice as many debutants, and 40% of new brands are designed for an audience with incomes above the average level. A similar situation was observed in 2015 - 42% of the operators that entered the market belonged to the premium and above-average price segments. "As a result of the increase in the exchange rate, some of our premium compatriots suddenly and with surprise found themselves with a shawarma and a glass of Sprite in their hands, although they could previously go out to a medium-sized restaurant several times a month," reflects Alexander Seregin, marketing director of the shopping centerMetropolis». Therefore, there is nothing surprising in the fact that there was a natural outflow from the premium segment to the middle, and from the middle to the lower. It seems to me that the brands of the Karen Millen, Ted Baker, FCUK, Versus level felt it the most, the second lines of the not very popular luxury are not yet Chanel, so that they are coveted and saved up for them, refusing the rent and a visit to the gynecologist, but UNIQLO is no longer available. In a crisis, traditionally the poor remain poor, the rich are mostly rich, the average flow into the category below. Therefore, now comes the golden time of the mass market. Buyers understand that they can no longer pay for an average label, preferring the same quality, but without a beautiful label and three times cheaper. A revelation awaits many. There are a number of inexpensive brands on the market that offer the same quality as the average, and sometimes even premium segment.

The mid-plus segment, which suddenly turned out to be at a premium price, according to Mikhail Gorshikhin, executive director of SmartUP CG, showed a maximum drop in sales by 40%. According to Daria Nuclear, CEO of Y Consulting, "repositioning in the minds of"buyers occurred with almost all brands more expensive than 100 euros in retail. "A striking example is the level brands Marella, Karen Millen, Reiss, Uterque, Massimo Dutti, Jeans Symphony (multi) and even Levi's," lists Ms. Nuclear. "Everything that costs more than 5000 rubles per unit of goods is not available to the mass buyer today, and these are individual products in ZARA, Marks & Spencer, the vast majority of things in Massimo Dutti and even Topshop." Considering that due to fluctuations in exchange rates, prices for clothing, shoes and accessories in Russia have increased from 20 to 70%, the fluctuation in audience perception can also be called significant, agrees Andrey Jacobi, CEO of Real Profit Group. Obviously, Tommi Hilfiger, Maje, Sandro, Iro, Reiss also went to premium for buyers in the end. «It is not necessary to go far – the changes can be traced by the example of the brand portfolio of our showroom “Li-Lu” – this is both Furla, and Coccinelle, and Patrizia Pepe, – supported by Oksana Bondarenko, president of the company «Show-room-Lu» and creative director of the brand of women's clothing and accessories «Li-Lu». – They really have become one hundred percent premium – both in price and availability for the Russian buyer».

The situation for the fashion industry is further complicated by the fact that, despite the twenty-year history of professional retail in Russia, the boundaries between segments are still too blurred in the country. So, analysts at Colliers International in Russia note that it is not yet necessary to talk even about a clear price division. "Brands positioned as the medium plus segment (Calvin Klein, Tommy Hilfiger, Lacoste), taking into account the exchange rate difference and the level of income of the population, are available to a wider audience of buyers in the USA than in Russia," explains Anna Nikandrova, partner at Colliers International in Russia. In general, the market of premium brands from the point of view of their representation in our country is still far from saturation. The main share is occupied by widely replicated brands, and the domestic buyer is simply not aware of many popular brands abroad. The most difficult thing, according to Indira Shafikova, CEO of ITD Properties Specialty Leasing, is now for those buyers who, for example, previously considered the Marella brand to be a brand with a low pricing policy, and now have to purchase an inexpensive item at an artificially inflated price. "In the same cage were Penny Black and Max Mara Weekend, which had not previously claimed the premium segment, but overnight became such," says Ms. Shafikova. At the same time, neither fabrics, nor accessories, nor the quality of tailoring has changed, and no one plans to develop these brands to the premium level. A regular jacket made of raincoat fabric on a sintepon with sleeves costs about 36 thousand rubles there, as previously could be observed with ESCADA-level brands. The price for a summer dress of the Marella brand this year is about 25,000 rubles, which has almost doubled compared to the same period last year.

"The devastation in the minds of"buyers with forced repositioning is also noted in FCG. "But the consumer behavior of buyers of all segments has changed," says Anush Gasparyan, Commercial Director of Fashion Consulting Group. Yes, in the premium segment, consumers began to make fewer purchases than before, take a more balanced approach to shopping: careful pre-planning, waiting for sales, searching for alternative options (either they prefer to buy the same brands, but less often, or they switch to cheaper brands of comparable quality, or they look for their favorite brand in outlets, discounters). Due to the falling demand, many premium companies do not reach their usual turnover. However, the transition of the medium plus segment brands to premium for market professionals, of course, did not happen. The price corridors of the segments have simply changed.

Some of the interlocutors noted that as a result of exchange rate jumps, buyers perceive even ZARA as a forced premium in the market. "Devoted fans of the brand could not help but note the increase in prices after the beginning of the crisis, which negatively affected the sales of the chain," says Anna Panyukova, head of services for retailers at JLL. – Part of the target audience was not ready to increase prices – in order not to lose a buyer, the retailer adjusted its pricing policy, however, such “testing” real demand did not go unnoticed in the market. Apparently, having appreciated the example of the recognized leader Inditex, other brands did not significantly revise the price tag or raised prices more cautiously. According to Yuri Ananyin, brand director of Campione, before the crisis, his company held a strong position in the medium plus segment, but now it has to cross the premium price threshold. "Of course, this is an exclusively local story and the positioning of the brand in other countries has not changed," says Mr. Ananyin. Most regular customers reduce wardrobe expenses by up to 50%; many prefer to save money and refrain from buying or buying things with decent discounts. Buyers are switching to brands a step or several steps lower, as evidenced by the growth of brands in the lower segment, which by the end of the year may occupy up to 60% of the market. However, there are also positive trends in the situation for us - getting into the premium segment can provide an advantage when entering retail chains. In turn, low assortment competition and lower rental rates are a good chance to take advantageous positions.

Author: Ekaterina Reutskaya

Photo: Shutterstock.com